Lot #: 43472

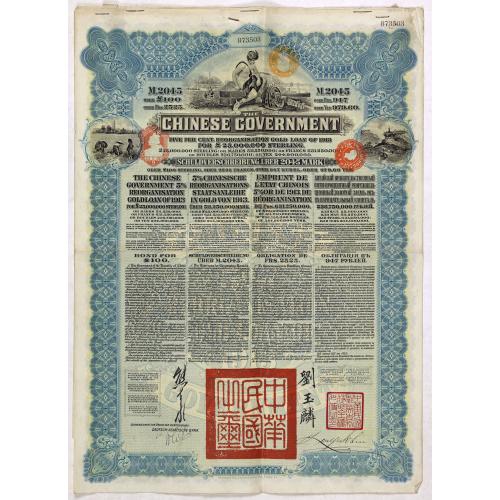

Imperial Chinese Government Five per cent reorganisation gold loan of 1913 for £ 25,000,000 sterling ... |

||||||||||||||||||||

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

$150

|

Views: 1723

|

|||||||||||||||||||

Description

China Government bond 873503 from 1913, Blue-Red. £100 5% Reorganization Gold Loan Bond, with 43 uncancelled coupons, - Issued by Deutsch-Asiatische Bank. Text is in English, German, French, and Russian.

Printed by Waterlow & Sons, extremely fine and extremely rare.

Verso conditions and amortisation table.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Purpose of the Gold Reorganization Loan

The purpose of the loan was to enable the new government of the Republic of China to meet financial liabilities inherited from the previous Chinese Imperial Government, for the reorganization of government institutions and to meet the administrative costs.

As an interesting footnote to this loan, Mr. M. E. Weatherall, who was a senior official of the Chinese Maritime Customs Service in 1921 was quoted in the publication “Wayfoong” as making the following observation.

“I believe that I am correct in saying that the greater part, if not all of the reorganization loan of 1913 was accounted for by statements and vouchers, but in actual fact very little of it was ever applied to the purposes for which it was lent. It disappeared mysteriously and nobody knows where it has gone.”

The Reorgansation Gold Loan of 1913 was for the capital sum of £25,000,000. The loan was authorised by Presidential Order of 22nd April, 1913 officially communicated by the Wai Chiao Pu to the Ministers in Peking of Great Britain, Germany, France, Russia, and Japan. (The Wai Chiao Pu was the Ministry of Foreign Affairs of the government of the Republic of China).

The newly appointed President of the Republic of China, Yuan Shih Kai initially approached Britain, France, Germany, and United States of America seeking a substantial loan to assist the fledgling government of the Republic of China. Later this group was expanded to include Japan and Russia, but eventually the U.S. withdrew from participation, leaving five countries which agreed to assist the Chinese Government with financial aid.

The principal financial institutions which participated in the loan arrangements were the Hongkong & Shanghai Banking Corporation, Deuthsch-Asiatiche Bank, Banque de l’Indo Chine, and Russian Asiatic Bank.

The Yokohama Specie Bank participated on behalf of Japan, but did not issue separate bonds, countersigned by the bank. Arrangements were made as to convertibility into Japnanese Yen of the bearer bonds issued to by other four issuing banks. The banks all received 6% commission for handling this loan and the capital amounts allocated to each bank together with bonds issued are detailed in the data below:

Hongkong & Shanghai Banking Corp. £7,416,000

Deutsch-Asicatiche Bank £6,000,000

Banque de l”Indo-Chine £7,416,660

Russian Asiatic Bank £2,777,780

Russian Asiatic Bank (Belgium) £1,388,880

Source : “Historic Foreign Bonds of China by John M. Thomson (2012).

See also a recent article of Trump and China Trade War & debts/a>

Printed by Waterlow & Sons, extremely fine and extremely rare.

Verso conditions and amortisation table.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Purpose of the Gold Reorganization Loan

The purpose of the loan was to enable the new government of the Republic of China to meet financial liabilities inherited from the previous Chinese Imperial Government, for the reorganization of government institutions and to meet the administrative costs.

As an interesting footnote to this loan, Mr. M. E. Weatherall, who was a senior official of the Chinese Maritime Customs Service in 1921 was quoted in the publication “Wayfoong” as making the following observation.

“I believe that I am correct in saying that the greater part, if not all of the reorganization loan of 1913 was accounted for by statements and vouchers, but in actual fact very little of it was ever applied to the purposes for which it was lent. It disappeared mysteriously and nobody knows where it has gone.”

The Reorgansation Gold Loan of 1913 was for the capital sum of £25,000,000. The loan was authorised by Presidential Order of 22nd April, 1913 officially communicated by the Wai Chiao Pu to the Ministers in Peking of Great Britain, Germany, France, Russia, and Japan. (The Wai Chiao Pu was the Ministry of Foreign Affairs of the government of the Republic of China).

The newly appointed President of the Republic of China, Yuan Shih Kai initially approached Britain, France, Germany, and United States of America seeking a substantial loan to assist the fledgling government of the Republic of China. Later this group was expanded to include Japan and Russia, but eventually the U.S. withdrew from participation, leaving five countries which agreed to assist the Chinese Government with financial aid.

The principal financial institutions which participated in the loan arrangements were the Hongkong & Shanghai Banking Corporation, Deuthsch-Asiatiche Bank, Banque de l’Indo Chine, and Russian Asiatic Bank.

The Yokohama Specie Bank participated on behalf of Japan, but did not issue separate bonds, countersigned by the bank. Arrangements were made as to convertibility into Japnanese Yen of the bearer bonds issued to by other four issuing banks. The banks all received 6% commission for handling this loan and the capital amounts allocated to each bank together with bonds issued are detailed in the data below:

Hongkong & Shanghai Banking Corp. £7,416,000

Deutsch-Asicatiche Bank £6,000,000

Banque de l”Indo-Chine £7,416,660

Russian Asiatic Bank £2,777,780

Russian Asiatic Bank (Belgium) £1,388,880

Source : “Historic Foreign Bonds of China by John M. Thomson (2012).

See also a recent article of Trump and China Trade War & debts/a>

FAQ - Guarantee - Shipping

In our BUY-or-BID sale, you never pay more than the Buy price.

To buy or bid in this Buy-or-Bid sale you must register with us. It is free, and we automatically update you about future auctions.During the Buy-or-Bid sale, you can buy or bid on 600- 900 antique, rare maps, town views, old master prints, decorative prints, atlases, posters and Medieval manuscripts.

- We show the "Bid & Ask spread" (to define the gap between the minimum accepted bid and Buy price.)

- Items that have received bids within the BidAsk spread are sold at the highest bid at closing.

- Once the Buy price is paid, the sale for this item has closed.

Do you have a similar item you want to sell ?

Interested in selling your antique maps, original prints, vintage posters, or historic Ephemera?Let us help you!

Start your consignment today. We provide estimates free of charge from photographs sent via the Internet. Fill out our online estimation form, and we will contact you with an estimate.

Learn more about consigning at RarePaperSales.com

Guarantee

We warranty the authenticity of each lot offered in our sale. There is no time limitation to this guarantee.

We warranty the authenticity of each lot offered in our sale. There is no time limitation to this guarantee.- Defects in lots have been carefully noted.

- If there are no remarks regarding splits, tears, discoloration, etc., there are no issues to be found for the item!

- All items are carefully and personally examined before being packed "in-house" and shipped by UPS, USPS, DHL or registered mail.

- We do not sell reproductions.

- A certificate of authenticity is provided for each acquired item and can be downloaded from your invoice page.

- Certificates can be found in the Invoice and Certificates center.

Shipping

Maps are shipped in solid tubes or flat between solid cardboard. Fully insured, signature required, and with online tracking. Shortly after shipment, you will get the tracking number by email.The standard is that we ship items by UPS or DHL for European destinations, and a flat shipping fee is added to each shipment. It is a one-time fee even if you buy multiple items. This fee covers shipping and insurance (up to the invoice amount) to:

- North America, Canada, Europe $ 30

- Asia $ 40

- For South America, Mauritius, Africa and Australia a shipping fee of $ 50 will be charged.

We charge only a one-time shipping fee if you have won 2 or more items.

Hold Shipment Service

Rare Paper Sales allows you to put your shipping on hold at no additional charge. This can be incredibly convenient for people who want to buy several items at different auctions and ship them together. The service is free, and you pay only one shipment fee.

Contact us if you want to use the Hold Service.

High-Resolution Digital Image Download |

|

|

RarePaperSales maintains an archive of most of our high-resolution rare maps, prints, posters and medieval manuscript scans. We make them freely available for download and study. Read more about free image download |